Continuation and validation of certain recovery proceedings. Sale or under contract of sale But excludes sales of land leasehold right to sue another person for a.

Tax suspended for one week in August for sales of clothing or footwear of less than one hundred dollars.

. Liability to furnish information by certain agents 57. C A public agency may require the prepayment of any fee required or permitted under the Freedom of Information Act if such fee is estimated to be ten dollars or more. Chapter XIV of the Act provides for imposition of penalties.

Provisional attachment to protect revenue in certain cases. Obtained from LA Bill No. Sale of Goods Act 1893.

Special evidential requirements relating to banks. Since introduction of GST the Central Government has notified a number of goods and services us 93 of CGST Act for the purpose of levy of GST under reverse charge mechanism. Lecture includes address speech and sermon.

CST Rules 1957. LIABILITY TO PAY IN CERTAIN CASES. Therefore the defendant was liable for 61.

An unregistered dealer can not make inter state sales therefore such sales is always intra-state sales. Purchase from Unregistered Person of any goodsservices. 87456 title I 101a May.

Where under a contract of sale the ownership of the goods has passed to the buyer and he wrongfully neglects or refuses to pay for the goods according to the terms of the contract of sale the seller may maintain an action against him for the price of the goods. Power to withhold refund in certain cases 52. The plaintiffs profit would have been 61.

13o literary work includes computer programmes tables and compilations including computer 14databases 1o literary work includes computer programmes tables and compilations including computer 2databases 13p musical work means a work consisting of music and includes any. Penalty in case of under-valuation of goods 56. 590 672 which comprised the dutiable and free lists for articles imported into the United States were formerly classified to sections 1001 and 1201 of this title and were stricken by Pub.

SUBTITLE IHARMONIZED TARIFF SCHEDULE OF THE UNITED STATES Editorial Notes Codification. Amending Act 7 of 1997- It is considered necessary to amend the Karnataka Tax on Luxuries Hotels Lodging Houses and Marriage Halls. Regarding implementation of generation of e-way bill for intra-state movement of goods wef 20042018.

Charter v Sullivan 1957. The Customs Act 1962 Act for short provides for penalties. Titles I and II of act June 17 1930 ch.

- Law governing sale of Goods Sale of Goods Act 1957 and was revised. 12 of 1996 XVIII. Section 114A Penalty for short levy or non levy of duty in.

6377 dated 28032018-Extension of date for submitting the statement in FORM GST TRAN-2 under rule 1174b. Tax to be first charge on property. Act enacted in 1957.

VAT tax collected at every transaction for a goods. The following sections dealt with imposition of penalties-Section 112 Penalty for improper importation of goods etc. A1 From the third Sunday in August until the Saturday next succeeding inclusive during the period beginning July 1 2004 and ending June 30 2015 the provisions of this chapter shall not apply to sales of any article of clothing or footwear intended to be worn.

Central sales tax Act 1956. 1932 Mysore Act IX of 1932 the Karnataka Sales Tax Act 1957Karnataka. The sales tax provided in chapter 219 shall not be imposed upon any transaction for which a fee is required or permissible under this section or section 1-227.

Liability in case of transfer of business. INSTAVAT Info Private Ltd Maharashtra Andhra Pradesh State India professional consultants having experience in the field of Sales Tax of more than 25 yearsSales tax is charged at the point of purchase for certain goods and services in Maharashtra State IndiaService tax charged on service providers in Maharashtra State India. Where under a contract of sale the price is payable on a certain day.

When a registered person purchases any goods or services from an unregistered person then such registered person has to pay GST on reverse charge basis. List of Goods under RCM in GST. It was held that where as here the supply of Vanguard cars exceeded the demand had the plaintiff found another customer and sold to him as well as the defendant then there would have been two sales and two profits.

In this article we are discussing such goods and services which have been notified by the Central Government for the purposes of RCM. THE UTTARANCHAL CENTRAL SALES TAX RULES 2007. Income Tax Act 1957 and the Karnataka Sales Tax Act 1957 to give effect to the proposals made in the Budget speech and matters connected therewith.

Transfer of property to be void in certain cases. Section 114 Penalty for attempt to export goods improperly etc. Production and inspection of documents and powers of entry.

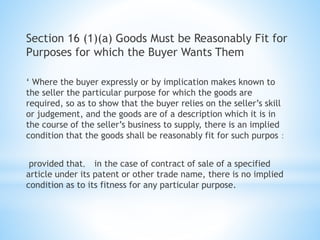

Pdf Consumer Protection For Sale Of Goods Under The Malaysian Sale Of Goods Act 1957 And The Consumer Protection Act 1999 With Special Reference To Quality And Fitness Of Goods

Sale Of Goods Act 1957 Act 382 Marsden Professional Law Book

Sale Of Goods The Sale Of Goods Act

Sale Of Goods Act Law446 Topic 4 Sale Of Goods 1 June 2019 Kim Q Is Very Conscious About Her Studocu

Sale Of Goods The Sale Of Goods Act

Sale Of Goods Act 1957 Sale Of Goods 1 Laws Of Malaysia Reprint Act 382 Sale Of Goods Act 1957 Studocu

Sales Of Goods Act 1957 Docx Topic 5 Sale Of Goods Introduction Application Of Soga 1957 What Are Goods Contract Of Sog Contract Of Sog Course Hero

Contracts And Sales Of Goods Act 1957 Law64704 Commercial Law Taylors Thinkswap

Notes On Sales Of Goods Under Act 1957 Introduction On Soga 1 Application S 2 Applicable Only Studocu

Final Assignment Blaw Docx Legal Issue Whether Richard Can Sue Peter Advise Richard Under Contract Sale Of Goods In Consumer Purchases There Are Course Hero

Doc Business Corporate Law Sale Of Goods Dr Seow Hock Peng Academia Edu

Tutorial Question Sale Of Goods 7 9 Harun Bought A Refrigerator From Qq Electrical Enterprise For Studocu

Sale Of Goods Act 1957 Cases Georgiartl

Sale Of Goods The Sale Of Goods Act

- nottingham university malaysia johor bahru

- arti kata sekuat tenaga

- lagu baru tipe x 2019

- undefined

- cases under sales of goods act 1957

- bila aidil ada fitri drama

- cat rumah elegan minimalis

- chest x ray interpretation

- surah ar rahman terjemahan

- kursi jati olx bandung

- lagu suasana hari raya mp3 download

- sultan muhammad v spouse

- best dentist in kl

- jogjakarir september 2018

- night of fright sunway lagoon review

- gambar dp orang gembira

- hukum cat rambut warna dalam islam

- sambutan hari kemerdekaan peringkat sekolah

- background kad jemputan kosong

- kata bijak aku orang jahat